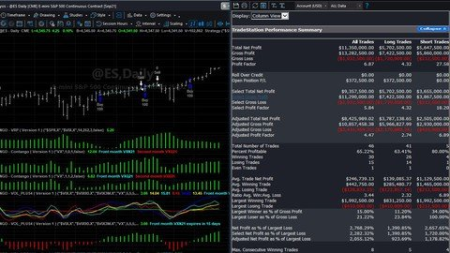

Video Training →Professional Financial Market Vibration Analysis System

Published by: LeeAndro on 16-03-2022, 14:58 |  0

0

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHzLanguage: English | Size: 2.71 GB | Duration: 3h 7m

Learn the basic market structure before you invest.

Emotionless but structured investing will put your on a success path

What you'll learn

Looking at Stock Market Structure

Knowing how the market vibrations works - No guesswork

Track the price levels of Stocks or any acommodity

the market using simple timing mode - put and price together for bias

Requirements

Course is for all levels

Description

Learn about stock market flow. After spending years at Etrade and Bank of America, it was clear what the public is missing and how they are misguided by wall street marketing. This course will bridge that gap to start the first step in the right direction. Through the Law of Vibration, every stock in the market moves in its own distinctive sphere of activity, as to intensity, volume, and direction; all the essential qualities of its evolution are characterized in its own rate of vibration. Stocks like atoms are really centers of enes, therefore they are controlled, mathematically. Although the Law Of Vibration comprises a number of elements, the factor is the most important. The price movement of a stock or commodity unfolds in a coherent way. This is because stocks and commodities are essentially centers of enes and these enes (or vibrations) are controlled mathematically. When the pattern is complete, it may suggest that the price is likely to find support or resistance at one of the Fibonacci levels calculated based on the price level of point D. Note that the Fibonacci levels are only displayed for the last Fibonacci pattern on the chart. Markets demonstrate repetitive patterns where prices oscillate between one set of price ratios and another making price projections possible. Market trends can be defined by geometric relationships as they exhibit harmonic relationships between the price and swings. Many investors/traders use cycles and harmonic relationships to project future swing price/s. These harmonic price movements produce symmetric rallies and decline to give traders an advantage to detee the key turning points. Symmetry is visible in all markets and in all frames.

Who this course is for

Anyone who wants to invest money in stock market

DOWNLOAD

uploadgig.com

https://uploadgig.com/file/download/310b68667b3ead1E/yVUylPlM__Profession.part1.rar

https://uploadgig.com/file/download/Eb57bA65fbC2630f/yVUylPlM__Profession.part2.rar

https://uploadgig.com/file/download/A35bB65a153aac95/yVUylPlM__Profession.part3.rar

rapidgator.net

https://rapidgator.net/file/73532070aaaa151d97c1e6d8fb0510a1/yVUylPlM__Profession.part1.rar.html

https://rapidgator.net/file/a6148fa1468e29640ccdc1c0705cc7bc/yVUylPlM__Profession.part2.rar.html

https://rapidgator.net/file/51f11f90e78d0939f567a7659cc9e62d/yVUylPlM__Profession.part3.rar.html

nitro.download

Related News

-

{related-news}